Due diligence is a critical part of the commercial real estate investment process. It refers to the investigation or research that is conducted by a potential investor to evaluate the feasibility and risks associated with a particular property before making an investment decision.

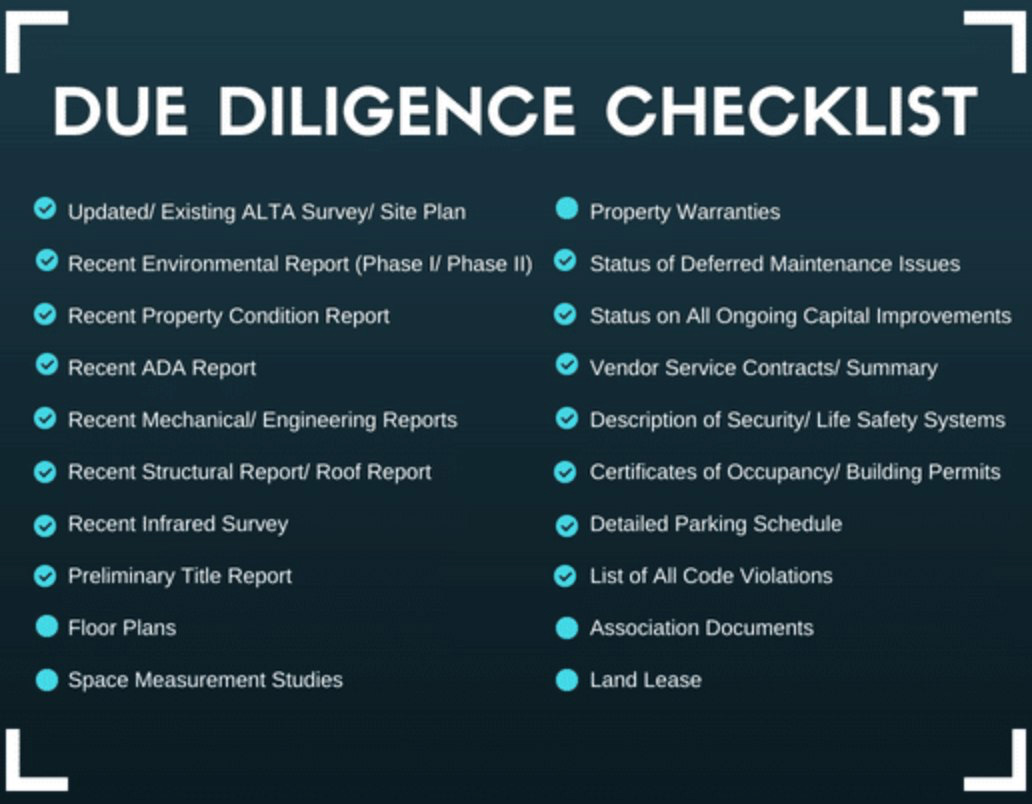

In commercial real estate, due diligence typically involves a thorough examination of a property’s physical, financial, and legal aspects. Some of the key areas that are typically covered during due diligence include:

Physical Inspection: A comprehensive review of the property’s physical condition, including its structure, systems (such as HVAC and electrical), environmental factors, and any necessary repairs or renovations.

Financial Analysis: An in-depth review of the property’s income and expenses, rental rates, occupancy rates, lease terms, and other financial factors that could impact the investment’s return.

Legal Review: A comprehensive review of the property’s legal status, including its ownership history, any liens or encumbrances, zoning regulations, and any pending litigation or environmental issues.

Market Analysis: An assessment of the local real estate market, including supply and demand dynamics, competition, and trends that could impact the property’s value.

By conducting due diligence, a potential investor can identify any potential issues or risks associated with a property and make a more informed investment decision. Due diligence helps investors to ensure that they have a complete understanding of the property’s potential and can mitigate any potential risks associated with the investment.